Optimism #91 - August 28, 2025

Dear clients and friends,

We are currently seeing impressive earnings reported from the shares of banks we own. Your September end portfolio values might blow your mind.

These Canadian boring stocks we own aren’t so boring at all.

And we have more good news. I was scheduled for jury duty for September 2nd. It has been cancelled so I can be available.

I’ve started investing in stocks: beef, chicken and vegetable. One day I hope to be a bouillionaire. (Jon Tillman)

Artificial Intelligence will no doubt affect financial planning. Try cutting and pasting the following two sentences into your favourite AI site and alter it to fit your details:

I am a 65-year-old male. I want $2,000 per month of investment income to supplement my pensions. Assuming 6% growth per annum and 3% inflation, how much do I need in savings?

The answer I get using Perplexity is instant and remarkable. It says $800 ,000 if I don’t want to spend principal and $461,911 if I do. Anyone can use this for free.

I was looking at RBC’s Treasury Bill fund. ‘T- bills’ as they are known, are the most guaranteed investment available. Fully government backed and liquid, so you can sell any moment.

We use them sometimes for a very guaranteed option for high interest savings. The problem is they don’t pay much interest. $10,000 invested RBC’s T-Bill Fund in 1991, with interest reinvested, is now $23,166. It did not even keep up with inflation - and this is pre- income tax. The safety of such safe investments is an illusion for the long-term investor.

Au contriare, RBC’s dividend fund, which started in January of 1993, $10,000 invested has become $223,237. (even with a management fee of 1.76% !)

I had to check my math again. It seems impossible but the return is about 16.2 times as much over 33 or so years.

This is why we need to ignore the news and hold those best of quality companies for decades.

The Liberal Government promised to reduce required annual RRIF withdrawals. Since we are living longer, this makes sense. Now they say they will follow through. Mike, a very astute client points out, it may backfire for some of us. Tax is only withheld on withdrawals in excess of the required ‘minimum’, so when the minimum is reduced, tax withheld at source increases. The bottom line is, the result may be more tax paid up front and larger tax refunds. If your draws are monthly, you may need to increase your RRIF amounts to result in the same net amount being deposited in your accounts. There was a similar one-time option about a decade ago and it was optional. We will see if the legislation gets pushed through.

Ottawa plans to follow through on GIS, RRIF relief for retirees - The Globe and Mail

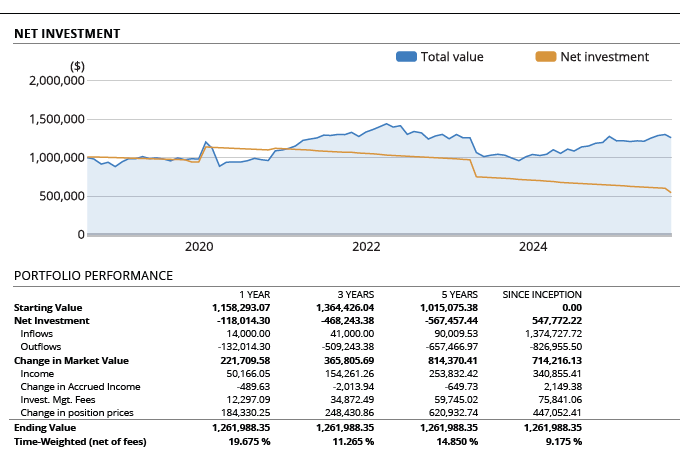

Here is another one of those beautiful charts we see on our statements. $1,000,000 ish was invested in 2018. They earned just over 9% return average, after fees. Another $90,009.53 was added but $826,955 was withdrawn. Today the account is 1.262 million. Not only did the money grow, but a partial transition from taxable to tax free accounts occurred. If I didn’t see this stuff every day, I would not believe it.

Keep your foot on the gas pedal. It’s working.

Enjoy the rest of your summer.

Derek Moran