Optimism #69 - November 10, 2023

Dear clients and friends:Here is one of those terrific articles. I highly recommend. Lots of wisdom. Thank you Scott Barlow at the Globe and Mail.

11 Things I Learned About Investing - by Frederik Gieschen (substack.com)

It seems we are near ‘peak worry’.

Stocks are cheap, yet Portfolio Managers I speak with are getting a record number of calls from worried investors.

I am no economist, but I like to watch human behavior. When it seems extreme, I’m interested.

The high level of concern tells me we are near the bottom. They call it capitulation, when people give up.

It’s also conveniently the time of maximum buying opportunity.

If you are still in your saving years, like me, it might be time to buy.

Another indicator I like to keep an eye on is the yield on bank stocks.

It’s only one metric, but useful in a general sense. When share prices fall, the dividend yield rises.

Normally bank shares are in the 4 to 4.5% range, or 45$ per year for every thousand dollars in your portfolio.

History tells us that when they were over 5%, that it was a good time to buy.

At the moment I write this, they are as follows. RBC (4.66%) , TD (4.74%), BNS (7.23%), CIBC (6.74%) and BMO (5.51%).

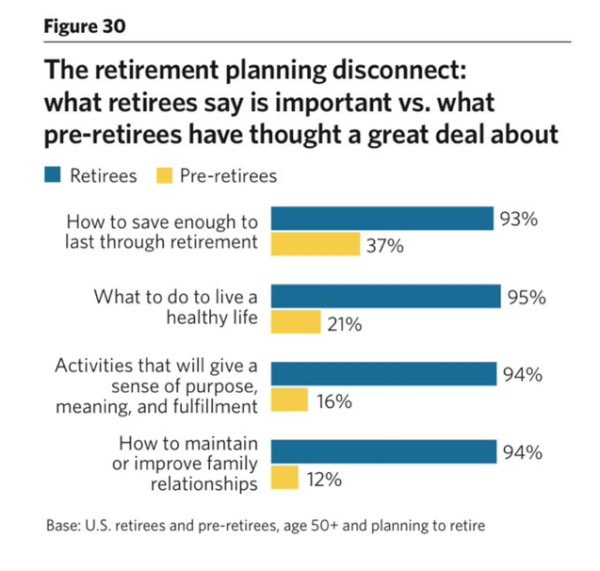

From Brendan Frazier, a colleague… definitely worth sharing.

“There is a glaring gap between what pre-retirees think is important and what retirees say is actually important once you get there.”

If you are a young adult who has never owned a home, but does not have the cash to fund one, I suggest opening the FHSA (first home savings) account anyway. Don’t wait until you have the money.

The 5-year, $8,000 per year opportunity window does not start until the account is opened.

This is confusing so I will use an example.

My daughter is 21 and has never owned a home.

If she opens an FHSA account this year, she can put in a max of $8,000.

If she opens the account, but does not contribute, she can put $16,000 in next year. (2 x $8,000)

Only once the account is established, the unused contribution room accumulates and may be carried forward.

If she waits until 2024 to set up the account, then she has missed an opportunity and can only put in $8,000 for 2024.

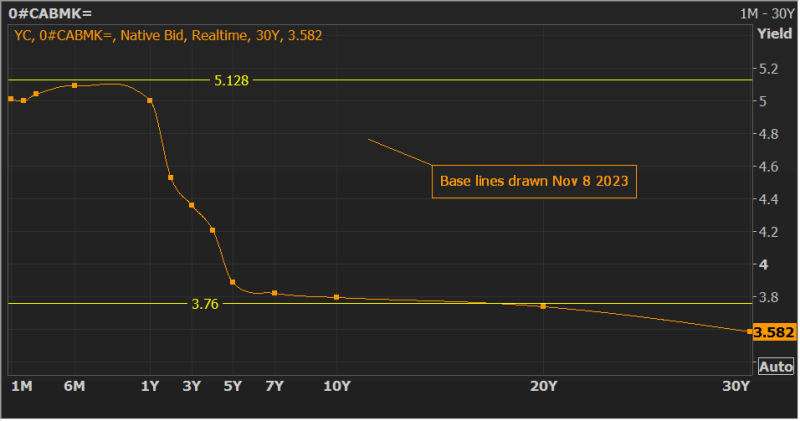

You maybe have heard comments about the inverted yield curve. Thank you John W for the chart. I don’t have access to this sort of detail very often.

On the bottom horizontal line, we see the range from 1m (1 month) to 30y (30 years).

On the right axis we see the yield, or interest rate an investor would get buy buying a bond, depending on the length of time to maturity.

Usually, we get more interest per year for buying the longest. A 30-year bond usually pays higher than a 1 year.

(You may be more familiar with mortgages, same concept. The rate on a 5-year mortgage is normally higher than on a two year.) Not these days.

As you can see below, its backwards, inverted so to speak, and has only happened 2 times (I think) in my near 30 years working. Food for thought.

According to Historic Vids, someone on X (Twitter), ‘Until 1956, French children attending school were served wine on their lunch breaks. Each pupil was entitled to four glasses a day.

Have a wonderful week,

Derek Moran