Optimism #72 - April 9, 2024

Dear clients and friends, I hope you are enjoying April so far.Very good news: these new trust rules will not apply for 2023.

New – Bare trusts are exempt from trust reporting requirements for 2023 - Canada.ca

Portfolios have rebounded significantly from their October lows.

I am working on my first case with an ALDA (Advanced Life Deferred Annuity).

The ‘ALDA’ was introduced in Canada about one year ago.

Here is how it works: we are working with a couple, she is 78 and he is 88. We will call them Bob and Jane.

Their income, largely from RRSPs, CPP & OAS, is about $110,000 per year.

They have about 1.1 million in savings.

Jane is vivacious, physically and mentally in great shape. They don’t need all of the income they are receiving for current living. However, she is concerned about running out of money due to funding Long Term Care costs for her husband and at the same time continuing to live independently herself.

I have some personal experience with long term care costs. My mother, and coincidentally a friend’s wife, went into long term care (LTC) at the same time in 2016. Both were here in Kelowna (Toronto and Vancouver are much more expensive). The friend’s household income was just under BC’s exemption, about $78,000 at the time. My parents’ income was a bit over that. His wife was placed in a subsidized bed for $1,700 a month and due to having too much income, my mother’s cost was $6,500 per month.

The couple’s goals are unconventional.

- Lower household income in the short term to qualify for subsidized long-term care.

- Have more income later because Jane might live a very long time.

Interest rates are higher than they have been for a while, so annuities are more compelling.

Only life insurance companies sell annuities. I requested a quote on their behalf.

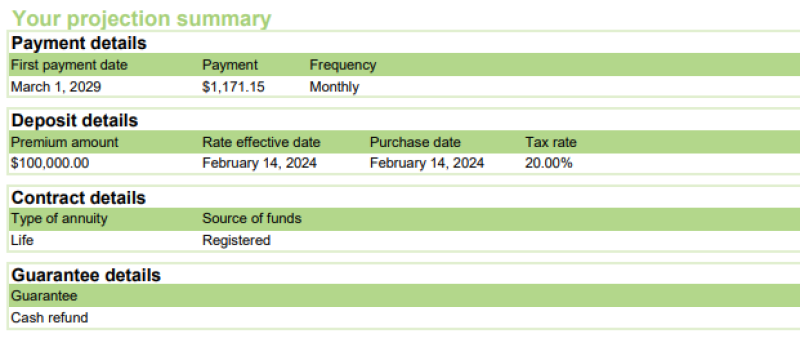

For simplicity we assumed $100,000 for the annuity, which may be scaled up or down. They provided the following quote:

Jane would receive $1,171.15 per year starting at her age 85, for life.

Using potato math, the break even would be after 85.3 months, or about seven years or her age 92.3.

If she lives to age 95, she will have collected 120 * $1,171.15 = $140,538.

By age 100, $210,807.

The deadline to purchase the annuity is age 80 so they will have to make a decision in fairly short order.

Will the annuity interest be as high as a portfolio of dividend growth stocks? Probably not, but if lowering their household income means successfully landing a subsidized home for her husband, the trade-off will likely outweigh the shortfall, plus provide certainty.

Tax implications of the annuity income are identical to the RRIF.

The ‘guarantee’ means money is fully refunded if she passes on before age 85.

The annuity is not indexed so inflation will dilute the purchasing power of the income over time.

Should she purchase the annuity? I’m interested in your thoughts.

Nice message today from Brian. He said:

“When I first set up my RESP, my advisor said I could have $80,000 by the time the girls are 18 years old.

Today they are 8 and 11 years old and there is $80,000 in the account. Dividend growth stocks, no flashy high-flyers.”

Have a super week.

Derek Moran