Optimism #50 - June 29, 2022

Dear clients and friends,There are many positive things happening to mention.

I bumped into a friend, Tyler Mordy, one of these early forties, exceptionally bright people who makes asset allocation decisions for Forstrong, a company managing a few billion dollars of other people’s money. He thinks we are near the bottom and the recession is already priced into stocks. He thinks it won’t be a ‘V’ shaped downturn like the covid one but we will slowly see asset prices rise from our current low prices.

There was an interesting piece in the New York times June 21st. The message: Government official’s answer to inflation “… is going to hurt.”

It’s a good thing you and I protect ourselves by owning stuff that is inflation protected.

Insiders buying at Slate office REIT, Cardinal Energy, Tourmaline Oil, Bonterra Energy, Primaris REIT, Canadian Western Bank, Firan Technology, Air Canada, Flagship Communities REIT, BSR REIT, Docebo Inc. and Aya Gold & Silver.

CIBC raised its profit margin target June 17th in the Globe and Mail, predicting that “… growth will go from 7% to 10% per year and be a different, more reliable bank.” I bought more shares personally.

Mark Carney, one of the brightest people literally in the world in my opinion, is in the Globe and Mail today, saying that Canada will fare better than others in this recession.

In The Economist magazine this week, it’s talking about The Next Phase of Globalization. I am sorry cannot provide the article or a link as it has a pay wall.

However, it talks about “how companies are moving out of China to places such as Vietnam. It’s about security not efficiency, doing business with people you can rely on. It could change the world economy for the better, keeping the benefits of openness while improving resilience.” All good.

The Wall Street Journal mentions that Johnson and Johnson has a better credit rating than the US Government.

Excellent article in the National Post about relaxing about markets in general. All will be fine.

Five daily affirmations to get investors through this latest bear market (msn.com)

Good article in the Globe about fighting inflation by investing in it.

A 17-pack of dividend-growth stocks for investors who want to flip the script on inflation - The Globe and Mail

My father’s neighbor in Arizona lives in Kelowna. She told him he should come for seven months per year instead of six.

I have heard different stories but wanted to confirm so I emailed a friend that knows this stuff. Glad I asked.

Hi Terry, I hope you are well.

I am thinking about sending my dad to Arizona for 7 months this year instead of the usual six. He would love it.

I file his 8840. He is a non-US person, BC resident.

Assuming he can get medical coverage for that long, am I missing anything?

Is it really that simple?

Thx, Derek

Hi Derek,

What you are missing is that he CANNOT physically be in the US for greater than 183 days under US immigration rules. In fact if we was caught being there over 6 mos., he could be barred for 3+ years. This has happened.

Further, he would not be able to file an 8840. He’d have to file a 1040NR and take a treaty disclosure to tie break residency back to Canada. But he would also have to file U.S. foreign bank reports as well. FinCEN 114. By filing the 1040NR, and tie breaking residency for tax purposes back to Canada, he is effectively admitting to the fact that he would have been in the U.S. greater than 183 days…..

Terry F. Ritchie, E.A., R.F.P, TEP

VP, Private Wealth Manager, Partner

Cardinal Point Capital Management & Cardinal Point Wealth Management

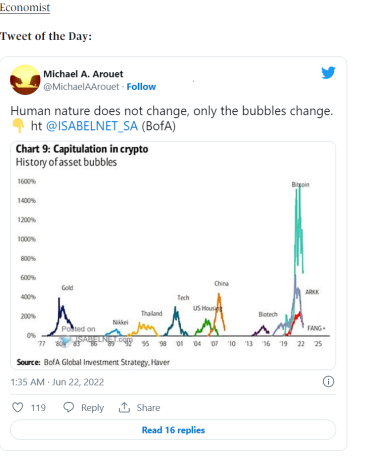

And to finish, a wonderful chart from Twitter & The Economist about investment bubbles. You will recognize them.

Have a tremendous finish to your week and a happy Canada Day weekend.

Derek Moran