OPTIMISM #31 - July 6, 2021

Dear clients and friends,I took the wording below from an investment newsletter called The Investment Reporter.

The author is referring to dividend paying / growing stocks and says:

Every day, investors are being told that mature, anti-anxiety dividend-paying stocks are past their prime. And that paying out all those dividends drains off the cash and stunts stock growth.

And they are told they would be better off with safe interest-bearing investments.

Don't fall for that nonsense.

The best anti-anxiety dividend stocks are the most powerful growth stocks you can have in your portfolio year after year.

Their calculations clearly show that a typical portfolio of supposedly safe, interest-bearing-only securities takes six long decades to double your income! That's 60 years.

Own these “anti-anxiety stocks” to reward yourself with a steady stream of high, monthly income in addition to the solid, impressive profits

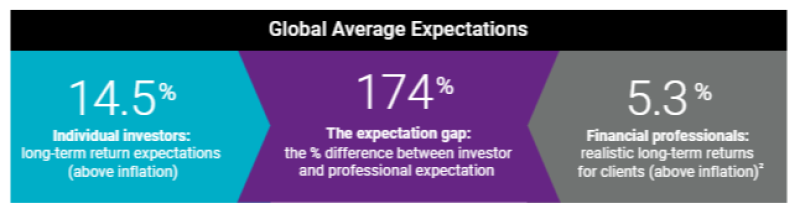

The ‘global expectation gap’. Thank you John for the reference. Its a reminder to keep our expectations reasonable. A recent study from Natixis suggested that investors have a long-term return expectations of 14.5% whereas financial professionals have a 5.3% return:

There is a wonderful article in the Globe today about how age 65 is being redefined. PDF attached as well.

https://www.theglobeandmail.com/investing/article-sixty-five-what-retirement-means-today/

And a super article in the Post about figuring out much spending your savings can support. I think the 4% rule or 25$ saved for every dollar of annual withdrawals is a bit too conservative, but it is a useful discussion starter.

How to figure out when you're financially independent so you can retire | Financial Post

Thank you Marc for the coffee cup and daily reminder of my genetic history:

If you are new to our idea sharing, you can read our other Optimism articles here:

Smarter Financial Planning - Optimism

Enjoy the summer!